Solution Highlights

- Complete KYC Compliance as per RBI Guidelines

- STQC Certified Fingerprint scanners

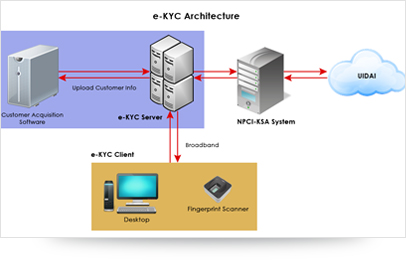

- NPCI / UIDAI interface

- Complete Audit trail

- Integration with any CBS

- Data download from UIDAI in < 20 seconds

e-KYC is an innovative solution to complete the Know Your Customer process electronically with direct authorization by the resident. The core idea of the e-KYC Aadhaar service is to enable individuals to authorise service providers to receive electronic copy of their proof of identity and address. Using this real time solution, one can provide services instantly to residents as the KYC details of the customer are verified and retrieved from UIDAI server online.

Features

- Fingerprint based beneficiary authentication

- One time password based beneficiary authentication

- Integration with Core banking system or Customer Acquisition Application

- End-to-end audit trail

Benefits

- Quick turn around time for account creation

- Eliminates physical submission of documents

- Hassle free account opening for customers